Lodha Plots Khopoli: India's Most Prestigious Luxury Real Estate Investment Opportunity

- 8th Dec 2025

- 451

- 0

Why India's Wealthiest Families Are Securing Premium Villa Plots in the Sahyadris

When India's largest real estate developer launches an ultra-luxury plotted development, smart investors pay attention.

When that development sits at the convergence of INR 2.1 lakh crore infrastructure investments, 90 minutes from South Mumbai, and offers 350–600+ sq yard luxury plots starting at INR 6.5 crore, discerning buyers act fast.

Lodha plots Khopoli represent something extraordinary: A rare opportunity to own premium land in one of India's fastest-appreciating corridors, backed by institutional-grade infrastructure, European-style masterplanning, and the unmatched execution credibility of Macrotech Developers (Lodha Group).

This isn't typical plotted development. This is luxury real estate in Khopoli reimagined at a level previously unseen in Western India's second-home segment.

After analyzing hundreds of luxury real estate opportunities across Mumbai Metropolitan Region, one conclusion is inescapable: Lodha plots Khopoli offer the most compelling combination of land ownership, appreciation potential, design freedom, and lifestyle excellence available today.

Let's explore exactly why.

Decoding Lodha Plots Khopoli: Understanding the Premium Positioning

First, absolute clarity on what makes these luxury plots in Khopoli, Raigad fundamentally different from typical Khopoli real estate.

Lodha plots Khopoli deliver:

- Premium villa plots spanning 350 sq yards to 600+ sq yards

- Meticulously planned European-style luxury villa estate

- Pricing from INR 6.5 crore to INR 14 crore and beyond

- Dramatic Sahyadri mountain setting along Khopoli-Pen Road

- 70–90 minutes from South Mumbai via Atal Setu

- Complete design freedom for custom luxury villa development

- Resort-style infrastructure and members-only club facilities

What these are NOT:

- Mass-market residential plots for budget buyers

- Agricultural land conversions with title complications

- Basic plotted layouts lacking premium infrastructure

- Standard developments with minimal amenities

This represents ultra-luxury land acquisition where Lodha applies the same rigor used in their INR 20 crore Worli penthouses—except here, buyers gain actual land ownership, complete architectural control, and exponentially superior appreciation trajectories.

The Investment Spectrum: Luxury Real Estate Khopoli Pricing Tiers

Understanding the pricing architecture helps identify optimal investment entry points.

Premium Entry Category: INR 6.5–8.5 Crore

- Plot dimensions: 350–400 sq yards

- Buildable potential: Approximately 4,500–5,200 sq.ft luxury villas

- Ideal for: Successful professionals, senior executives, established entrepreneurs

- Investment rationale: Entry into Lodha's ultra-luxury ecosystem at relatively accessible pricing

Ultra-Premium Category: INR 8.5–11.5 Crore

- Plot dimensions: 450 sq yards

- Buildable potential: Approximately 5,800–6,500 sq.ft villas

- Ideal for: Business owners, CXOs, family offices

- Investment rationale: Optimal balance of land, exclusivity, and long-term value appreciation

Signature Estate Category: INR 12–14+ Crore

- Plot dimensions: 600+ sq yards

- Buildable potential: 7,500+ sq.ft palatial villas

- Ideal for: Ultra-high net worth individuals, legacy wealth creators

- Investment rationale: Maximum land ownership, superior estate positioning, absolute privacy

Strategic insight: When evaluating luxury plots investment opportunities, recognize that pricing reflects not merely land area but position within the estate—view quality, privacy levels, proximity to amenities, and natural features all command premiums that compound during ownership and resale.

21 Compelling Reasons Lodha Plots Khopoli Dominate Luxury Real Estate Investment

Let's examine the complete picture of why these premium plots represent exceptional value.

1. Institutional Developer Credibility Eliminates Execution Risk

Lodha (Macrotech Developers) stands as India's largest real estate developer by sales, with:

- Over 4 lakh satisfied homeowners across India

- 90+ million sq.ft of delivered projects

- INR 30,000+ crore in ongoing developments

- Presence across Mumbai, Pune, Bangalore, Hyderabad, Delhi-NCR

When investing INR 6.5–14 crore in luxury real estate Khopoli, developer credibility isn't negotiable. Lodha's execution track record, financial stability, and brand reputation provide:

- Zero project abandonment risk

- Delivery timeline reliability verified across decades

- Quality standards maintained consistently

- Professional post-possession community management

- Financial strength to weather any market cycles

In ultra-premium real estate, the developer premium isn't a cost—it's insurance that protects your entire investment.

2. European Masterplanning Standards Rarely Seen in India

Lodha plots Khopoli feature world-class estate design that fundamentally differentiates this development.

Landscape architecture excellence:

- Entire estate conceived as cohesive European countryside experience

- Every plot positioned to maximize Sahyadri mountain and river views

- Intelligent terracing preserving natural topography

- Curated plantings creating year-round botanical beauty

- Private access roads designed for aesthetic experience

- Completely concealed infrastructure—no overhead wires or exposed utilities

Spatial planning sophistication:

- Strategic buffer zones ensuring genuine privacy between plots

- Natural screening using mature tree installations

- Positioning eliminating all "overlooking" concerns

- Each plot experiencing independent estate character despite community setting

This level of masterplanning would cost INR 50+ crore to replicate independently—yet Lodha plots buyers access it through shared infrastructure investment.

3. Strategic Location Between India's Two Economic Powerhouses

Khopoli occupies the precise midpoint between Mumbai and Pune, creating unique dual demand dynamics.

Current connectivity from luxury plots location:

- South Mumbai: 70–90 minutes via Atal Setu

- Navi Mumbai: 50–55 minutes

- Pune City: Approximately 2 hours

- Lonavala: 25 minutes

This positioning captures demand from both metropolitan regions—Mumbai's HNIs seeking weekend retreats and Pune's affluent buyers wanting hill station proximity—while avoiding the congestion plaguing established destinations like Lonavala.

4. Just 50 Minutes From Navi Mumbai International Airport

Proximity to NMIA (operational 2025) positions Lodha plots Khopoli in the highest-impact airport influence zone.

NMIA transformation factors:

- 90 million passenger annual capacity

- India's first fully digital international airport

- Massive employment generation across logistics, aviation, IT, hospitality

- Billions in corporate infrastructure investment

Historical precedent worldwide: Properties within 50 km of new international airports consistently deliver 5–7 times appreciation within one decade.

Lodha luxury plots in Khopoli sit perfectly positioned to capture this airport premium.

5. NAINA's INR 2.1 Lakh Crore Mega-Development Spillover Effect

Khopoli lies adjacent to NAINA (Navi Mumbai Airport Influence Notified Area)—India's most ambitious planned urban expansion.

NAINA scale:

- 90,000-acre development footprint

- INR 2,10,000 crore committed investment pipeline

- Participation from Reliance, Adani, global infrastructure giants

- 8–10 lakh projected job creation over next decade

- Massive IT parks, commercial zones, residential townships

As NAINA develops, demand naturally flows toward well-connected, premium locations offering superior value—exactly where luxury real estate in Khopoli, especially Lodha's development, sits strategically.

6. Infrastructure Convergence Creating Unprecedented Connectivity

Eight major infrastructure projects converging around Khopoli simultaneously—an extremely rare occurrence.

Already operational:

- Atal Setu (MTHL) cutting South Mumbai to Navi Mumbai from 90 minutes to just 20 minutes

- Upgraded Mumbai-Pune Expressway with enhanced capacity

Under construction or upcoming:

- Panvel-Karjat Railway Line (completion 2026–27)

- Mumbai Metro Line 8 providing airport-to-airport connectivity

- Virar-Alibaug Multi-Modal Corridor

- Missing Link Expressway

- Kusgaon Bypass saving 20–30 minutes

- BKC-NMIA High-Speed Tunnel

Impact on travel times by 2027:

- Lonavala: Currently 25 mins, reducing to 15 mins

- NMIA: Currently 50 mins, reducing to 20–25 mins

- South Mumbai (Parel): Currently 90 mins, reducing to 45–50 mins

- Panvel: Currently 50 mins, reducing to 35 mins

- Pune: Currently 120 mins, reducing to 75 mins

Faster connectivity directly translates to higher property valuations—a pattern consistently observed across global real estate markets.

7. Explosive Price Appreciation: 4.4 Times Growth in Just 3 Years

Khopoli has delivered the strongest land price appreciation across all MMR emerging markets.

Documented growth:

- 4.4 times appreciation over 3 years

- 2.7 times growth in just the previous 12 months

- Consistently outperforming Panvel, Karjat, Navi Mumbai suburban areas

This acceleration demonstrates powerful investor confidence, infrastructure momentum catalysis, and substantial future growth potential.

For Lodha plots Khopoli buyers, entry timing remains optimal—positioned at market inflection point rather than peak saturation.

8. Optimal Plot Sizes Matching Luxury Villa Development Demand

Market data conclusively shows 350–600 sq yard plots selling significantly faster than other size categories.

Why these dimensions dominate:

- Perfect scale for high-end luxury villa construction

- Enables duplex or palatial single-story configurations

- Ideal for premium Airbnb and short-stay rental models

- Attracts largest buyer pool ensuring maximum resale liquidity

Lodha's plot sizing directly addresses the luxury segment's most active demand zone, ensuring both development feasibility and exit market depth.

9. Transaction Volume Surge Confirming Market Maturity

Between FY 2020-21 and FY 2024-25, Khopoli's real estate transaction volume increased three times, with projections showing continued doubling by FY 2029-30.

When both price AND volume rise simultaneously, it signals:

- Genuine end-user demand rather than speculative bubbles

- Market maturation with institutional participation

- Sustainable long-term growth fundamentals

- Strong investor conviction

This validates luxury real estate Khopoli as legitimate wealth creation opportunity rather than transient trend.

10. Tourism-Driven Rental Income Potential

Unlike most ultra-premium real estate investments, luxury villas in Khopoli generate substantial rental income.

Current market rates:

- Premium villas: INR 20,000 to INR 1,10,000 per night

- Mid-tier luxury stays: INR 8,000–15,000 per night

- Established hotels (Novotel, Radisson): INR 12,000–22,000 per night

- Average annual occupancy: 60 percent

Lodha brand advantage: Professional hospitality management and brand premium enable 20–30 percent higher rental pricing versus independent luxury villas in Khopoli.

11. Robust Industrial Foundation Ensuring Sustained Demand

Khopoli's strong industrial ecosystem provides economic stability beyond tourism.

Industrial assets:

- Thriving MIDC industrial zones

- Major manufacturing clusters

- Dedicated logistics parks boosted by NMIA proximity

- Data centers from global technology companies

This industrial backbone ensures year-round residential demand, sustainable job creation, and balanced economic growth—not seasonal tourism dependency alone.

12. Superior Price-to-Growth Ratio Across MMR

Comparative analysis reveals Lodha plots Khopoli offering exceptional value despite premium positioning.

Approximate current market rates:

- Panvel plots: INR 8,000–12,000 per sq.ft

- Lonavala plots: INR 6,500–11,000 per sq.ft

- Navi Mumbai: INR 15,000–25,000 per sq.ft

- Lodha plots Khopoli: INR 6,500–9,500 per sq.ft (effective rate including infrastructure)

Despite world-class masterplanning and resort-style amenities, pricing remains 40–60 percent more attractive than comparable luxury locations while offering superior infrastructure delivery certainty.

13. Transformation From Peripheral Location to Core MMR Hub

Khopoli's identity evolution mirrors Thane and Vashi's earlier trajectories.

Transformation drivers:

- World-class infrastructure convergence

- International airport connectivity

- Expanding industrial and commercial sectors

- Premium township developments

- Growing tourism and hospitality economy

What was peripheral five years ago is now rapidly becoming a recognized core growth center within Mumbai Metropolitan Region.

14. Multiple Tier-1 Developers Validating the Market

Institutional capital flowing into Khopoli provides powerful validation.

Major developers actively launching:

- Lodha (Macrotech Developers)

- Godrej Properties

- HOABL (House of Abhinandan Lodha)

- SVB Realty

- Hiranandani Developers

- NeoLiv

- Embassy Developers

When INR 5,000+ crore institutional capital enters a micro-market within 24 months, it signals strategic conviction based on rigorous research—not speculative risk-taking.

15. Township-Scale Projects Creating Complete Ecosystems

Large-scale developments transforming Khopoli's real estate landscape.

Project characteristics:

- 200–500 unit gated communities

- INR 200–500 crore investment scales

- Complete social infrastructure including schools, healthcare, retail

- International-standard amenities and community facilities

Lodha's superior financial strength ensures fastest delivery and highest quality standards versus smaller competitors.

16. Perfect Alignment With India's Lifestyle Megatrends (2025–2030)

Lodha plots Khopoli capture every significant real estate trend shaping the next decade.

Megatrends driving demand:

- Remote work enabling permanent second-home adoption

- Airport proximity becoming premium requirement

- Plotted developments strongly preferred over apartments

- Wellness and nature-living demand surge

- Real estate portfolio diversification beyond equities and mutual funds

- Experiential luxury prioritized over purely transactional purchases

These aren't cyclical shifts—they represent structural, long-term demographic and lifestyle evolution.

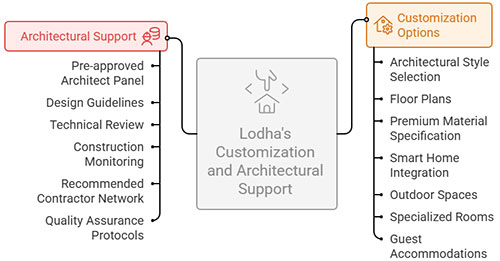

17. Complete Design Freedom for Custom Villa Development

Unlike purchasing ready-built villas, luxury plots in Khopoli provide total architectural control.

Customization possibilities:

- Architectural style selection (European classical, contemporary minimalist, tropical modern)

- Floor plans tailored to exact lifestyle requirements

- Premium material specification (Italian marble, imported fixtures, sustainable features)

- Smart home integration levels

- Outdoor spaces including infinity pools, terraced gardens, entertainment areas

- Specialized rooms: home theaters, wine cellars, private gyms, libraries

- Guest accommodations, service quarters, additional storage

Lodha's architectural support:

- Pre-approved architect panel access

- Design guidelines ensuring aesthetic consistency

- Technical review and engineering consultation

- Construction monitoring services available

- Recommended contractor network

- Quality assurance protocols

A custom-designed INR 4–6 crore villa on a INR 10 crore Lodha plot will consistently outperform a INR 14 crore ready-built villa from both lifestyle satisfaction and resale value perspectives.

18. Resort-Style Members-Only Club Infrastructure

Lodha plots buyers access world-class amenities that would cost INR 50+ crore to develop independently.

Club facilities included:

- Multiple specialty restaurants and gourmet cafés

- Professional hospitality management team

- Luxury fitness center and spa facilities

- Infinity swimming pool with Sahyadri mountain views

- Indoor sports (squash, badminton, billiards, table tennis)

- Outdoor sports (tennis courts, cricket pitch, adventure zones)

- Children's activity centers and safe play areas

- Business center and premium co-working spaces

- Library, meditation pavilions, yoga studios

- Event spaces for private celebrations

Curated lifestyle experiences:

- Gourmet dining programs and culinary events

- Cultural performances, music, art exhibitions

- Guided nature walks, trekking, adventure activities

- Wine tastings, chef's table experiences

- Wellness programs, yoga retreats, fitness workshops

- Seasonal festivals and community celebrations

This infrastructure transforms luxury plots in Khopoli from real estate investment into comprehensive lifestyle ecosystem.

19. RERA Protection and Regulatory Maturity

Lodha projects deliver institutional-grade legal compliance.

Regulatory advantages:

- Full RERA registration and transparency

- Clear land titles with complete ownership chain verification

- Banking sector participation (home loans readily available)

- Professional documentation standards

- Established grievance redressal mechanisms

For investors committing INR 6.5–14 crore, regulatory confidence isn't optional—it's fundamental to investment security.

20. The Sahyadri Natural Setting Advantage

The actual location delivers natural assets rarely available near major metros.

Environmental quality:

- Dramatic Sahyadri mountain range views (not distant hills)

- Pristine river views and natural water bodies

- Year-round lush greenery from favorable microclimate

- 3–5 degrees Celsius cooler temperatures than Mumbai year-round

- Measurably superior air quality versus metropolitan areas

- Minimal light pollution enabling genuine starlit skies

- Natural soundscape replacing urban noise

Accessibility without compromise:

- 70–90 minutes from South Mumbai

- 50–55 minutes from Navi Mumbai International Airport

- 25 minutes to Lonavala for additional weekend options

- Yet completely removed from urban congestion and chaos

Neighborhood quality:

- 3 minutes to serene Donvat Dam for walks and sunset viewing

- 5-minute walk to historic Shri Harihareshwar Shiv Mandir

- 20 minutes to Imagicaa Theme Park

- 20 minutes to premium hospitality (Novotel, Radisson)

- Multiple trekking trails, waterfalls, adventure zones nearby

This combination—luxury plus nature plus accessibility—is extraordinarily rare in India's real estate landscape.

21. Conservative 3–4 Times Appreciation Forecast by 2030

Based on infrastructure delivery timelines, NMIA operationalization, NAINA momentum, and historical airport-corridor appreciation patterns, expert projections suggest:

Lodha plots Khopoli could appreciate 3–4 times over the next 4–5 years.

Translation for investors:

- INR 6.5 crore plot today potentially worth INR 20–26 crore by 2030

- INR 10 crore plot today potentially worth INR 30–40 crore by 2030

- INR 14 crore plot today potentially worth INR 42–56 crore by 2030

- Expected CAGR: 20–32 percent

This growth trajectory is backed by multiple economic catalysts, not single-factor dependency, making the forecast conservative rather than optimistic.

Financial Analysis: Complete Investment Modeling

Understanding total investment requirements and return projections.

All-In Investment Breakdown for INR 10 Crore Plot

Complete cost structure:

- Plot acquisition: INR 10 crore

- Stamp duty and registration: INR 70 lakhs (7 percent)

- Luxury villa construction (5,800 sq.ft at INR 8,000–10,000/sq.ft): INR 4.5–6 crore

- Premium interior and furnishing: INR 1.5–2.5 crore

- Landscaping and outdoor development: INR 40–60 lakhs

- Professional fees (architects, consultants): INR 30–40 lakhs

- Total investment: INR 17–19.5 crore

Five-Year Value Projection

Conservative scenario:

- Plot appreciation: INR 10 crore to INR 25 crore

- Villa value addition: INR 7–8.5 crore (construction plus interiors)

- Total property value (2030): INR 32–33.5 crore

- Net appreciation: INR 13–16 crore

- Effective CAGR on total investment: 13–16 percent

Plus rental income throughout holding period:

- Conservative annual rental: INR 50–70 lakhs

- Five-year cumulative rental: INR 2.5–3.5 crore

- Total returns: INR 15.5–19.5 crore over five years

This combination of land appreciation, villa value creation, and rental income represents exceptional wealth creation in luxury real estate.

Rental Yield Modeling for Luxury Villas in Khopoli

Premium short-stay rental model:

- Peak season rates (October–May): INR 1,50,000–3,50,000 per week

- Off-season rates (June–September): INR 80,000–1,50,000 per week

- Average occupancy: 50–65 percent

- Annual gross rental income: INR 50–90 lakhs

For INR 17 crore total investment:

- Conservative yield: 3–4 percent (INR 50–70 lakhs annually)

- Aggressive management yield: 4–6 percent (INR 70–90 lakhs annually)

Lodha's professional hospitality management and brand premium command 20–30 percent higher rental rates than independent luxury villas in Khopoli—a significant advantage for income-focused investors.

Comparative Luxury Real Estate Pricing Analysis

What INR 10 crore buys across competing markets:

Lonavala luxury plots:

- 300–350 sq yards in crowded areas with basic infrastructure

- Weekend traffic congestion significantly impacts usability

- Mature market with limited appreciation runway (10–15 percent CAGR projected)

Alibaug luxury plots:

- 300–350 sq yards requiring 3+ hour commute including ferry

- Beach proximity advantage but seasonal usability constraints

- Limited infrastructure catalysts (12–18 percent CAGR projected)

Karjat premium plots:

- Could acquire 500+ sq yards but with smaller developer risk

- Limited infrastructure delivery certainty

- Fewer appreciation catalysts

Lodha plots Khopoli:

- 450 sq yards with world-class infrastructure

- 90 minutes from Mumbai with improving connectivity

- Multiple infrastructure catalysts

- Resort-style amenities included

- Institutional developer backing

- 20–32 percent CAGR projected

Conclusion: On pure value basis—land area, infrastructure quality, location fundamentals, developer credibility, appreciation potential—Lodha plots Khopoli offer 40–60 percent better value proposition than competing luxury real estate options.

Ideal Investor Profiles for Luxury Plots in Khopoli

Understanding who benefits most from this investment opportunity.

Established Metropolitan HNI Families

- Age: 40–65 years

- Net worth: INR 75 crore plus

- Annual income: INR 3–8 crore plus

- Current residence: Premium apartments in Worli, Malabar Hill, Cuffe Parade, Nerul

- Motivation: Legacy luxury villa, family retreat, real estate portfolio diversification

- Investment comfort: INR 17–25 crore all-in without financial stress

Successful Business Owners and Entrepreneurs

- Age: 35–55 years

- Business: Mid-to-large enterprise ownership

- Net worth: INR 150 crore plus

- Motivation: Custom dream home development, wealth preservation asset, multi-generational legacy

- Investment comfort: INR 20–30 crore (plot plus luxury villa development)

Non-Resident Indian Investors

- Age: 40–70 years

- Location: USA, UK, Middle East, Singapore, Australia

- Net worth: USD 8 million plus

- Motivation: India connection, retirement planning, family heritage property

- Investment comfort: INR 15–25 crore (USD 2–3 million equivalent)

Young Wealth Creators

- Age: 30–45 years

- Source: Startup exits, early technology/equity success, family business succession

- Net worth: INR 50–100 crore

- Motivation: Lifestyle upgrade, asset diversification beyond equities, weekend productivity space

- Investment comfort: INR 12–18 crore (smaller plots with efficient villa design)

Common characteristics across successful buyers:

- Value quality over cost considerations

- Understand land as finite, appreciating asset class

- Appreciate design freedom that plotted developments offer

- Recognize institutional credibility eliminating execution risk

- Seek emotional satisfaction combined with financial returns

Strategic Investment Framework: Evaluation Methodology

Systematic approach for assessing this luxury real estate opportunity.

Phase One: Discovery and Experience (Weeks 1–2)

Essential activities:

- Schedule comprehensive site visit (minimum half-day duration)

- Experience Sahyadri setting and microclimate firsthand

- Walk multiple plot categories and positioning options

- Assess actual connectivity by driving from residence to site

- Meet project team and understand development vision

- Review detailed masterplan and landscape architecture plans

Critical questions:

- Exact plot dimensions, floor area ratio, building regulations

- Infrastructure and club delivery timelines

- Payment schedule and milestone-linked structure

- Customization freedom and approval processes

- Post-possession community management model

- Villa construction support and architect panel details

Phase Two: Comparative Analysis (Weeks 2–3)

Research activities:

- Visit 2–3 competing luxury plotted developments

- Compare per-sq-yard pricing across markets

- Assess infrastructure quality differences

- Evaluate developer track records and financial stability

- Analyze resale market depth for each location

Financial modeling:

- Calculate total all-in investment (plot, construction, interiors)

- Model rental income scenarios

- Project appreciation across different cases

- Assess liquidity and exit timelines

Phase Three: Due Diligence (Weeks 3–4)

Critical verifications:

- RERA registration certificate review

- Land title search and ownership chain verification

- Approved layout plans and NOC documentation

- Environmental clearances and regulatory compliances

- Payment structure and escrow mechanisms

- Builder-buyer agreement legal review

Professional consultations:

- Engage independent real estate lawyer (INR 50,000–1,00,000)

- Consult architect for buildability assessment

- Financial advisor input on portfolio allocation

- Tax consultant for optimal ownership structure

Phase Four: Plot Selection (Weeks 4–5)

Selection criteria (priority order):

- View quality (Sahyadri panorama over partial views)

- Privacy level (corner or end plots preferred)

- Proximity to club (convenience versus seclusion balance)

- Natural features (existing trees, elevation, unique characteristics)

- Adjacent plot development potential

- Resale appeal assessment

Financial structuring:

- Own funds versus home loan optimization

- Payment plan selection (longer terms hedge inflation)

- Tax-efficient ownership structure (individual, HUF, company)

- Estate planning integration

Phase Five: Booking and Planning (Weeks 5–8)

Booking process:

- Negotiate optimal payment terms

- Clarify all customization approvals in writing

- Understand milestone-linked payment triggers

- Secure plot-specific location guarantees

Villa planning:

- Shortlist architects (approved panel or independent)

- Begin conceptual design process

- Budget construction and interiors realistically

- Plan phased development if appropriate

Strategic insight: In luxury plotted developments, INR 6.5 crore plots with exceptional positioning often outperform INR 12 crore plots in mediocre locations from both lifestyle satisfaction and resale value perspectives. Prioritize position over size when budget constrained.

Final Investment Perspective

After comprehensive analysis across location fundamentals, developer credibility, pricing comparison, infrastructure timelines, appreciation potential, and rental yield opportunities, the conclusion is clear:

For high-net-worth individuals seeking premier luxury real estate investment in Western India with complete design freedom, Lodha plots Khopoli represent exceptional value.

Investment strengths:

- Land ownership of finite, appreciating asset

- Complete architectural control for dream villa development

- Institutional developer execution eliminating delivery risk

- Perfect market timing at inflection point rather than peak

- Resort-style infrastructure unattainable independently

- Rare combination of 20–32 percent appreciation plus 3–6 percent rental yield

- Lodha brand premium ensuring strong resale liquidity

- Multi-generational legacy asset with emotional value

Considerations requiring careful evaluation:

- Total investment of INR 17–25 crore (plot plus villa development)

- Development timeline of 2–3 years (plot) plus 2 years (villa construction)

- Premium pricing versus mass-market Khopoli options

- Long-term hold requirement for maximum appreciation capture

The fundamental truth:

Lodha plots Khopoli aren't mass-market real estate. They represent ultra-luxury land banking for India's most discerning investors who understand that true wealth creation comes from combining institutional-grade execution, strategic location timing, and genuine scarcity.

If this investment represents comfortable allocation rather than financial stretch, and the combination of emotional satisfaction plus financial returns appeals strongly, this opportunity likely represents the finest luxury real estate proposition available in Western India for the current decade.

The convergence of Lodha's execution excellence, Khopoli's infrastructure momentum, and authentic scarcity of ultra-luxury plotted developments creates a genuinely rare opportunity.

The decision now rests with discerning investors who recognize exceptional value when market timing, location fundamentals, and institutional credibility align perfectly.

Comments

No comments yet.

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading blog post